Tax In China

Overview of Tax in ChinaAs one of the largest markets in the world,Website:, China is attracting increasing global investors. In order to run your business in the most efficient manner, you should understand the potential tax costs that would incur before incorporating a China company such as a WOFE, and needless to say, after your China company has been established. An overview of major taxes applicable to foreign investors are listed as follows:Tax on income●Corporate income tax ("CIT"): the standard tax rate is 25%, but if your company is engaged in High Tech industries encouraged by the government, your tax rate can be reduced to 15%. Tax holiday is applicable to certified high tech enterprises. ●Individual income tax ("IIT") - progressive rates range from 3% to 45%.Tax on transactions (turnover tax)●Value-added tax (VAT) – applicable to the sale of all goods (real estate excluded). The standard tax rate is 17%. Certain necessities are taxed at 13%.●Business tax – The standard tax rates range from 3% to 20%. Applicable to provisions of services (excluding processing, repair and replacement services), transfer of intangible properties and the sale of real estate properties in China. Other Taxes●Land appreciation tax●Resources tax●Real estate tax●Vehicle and vessel tax●Motor vehicle acquisition tax ●Stamp tax●Tax levied by the Customs●Custom duties●Deed tax

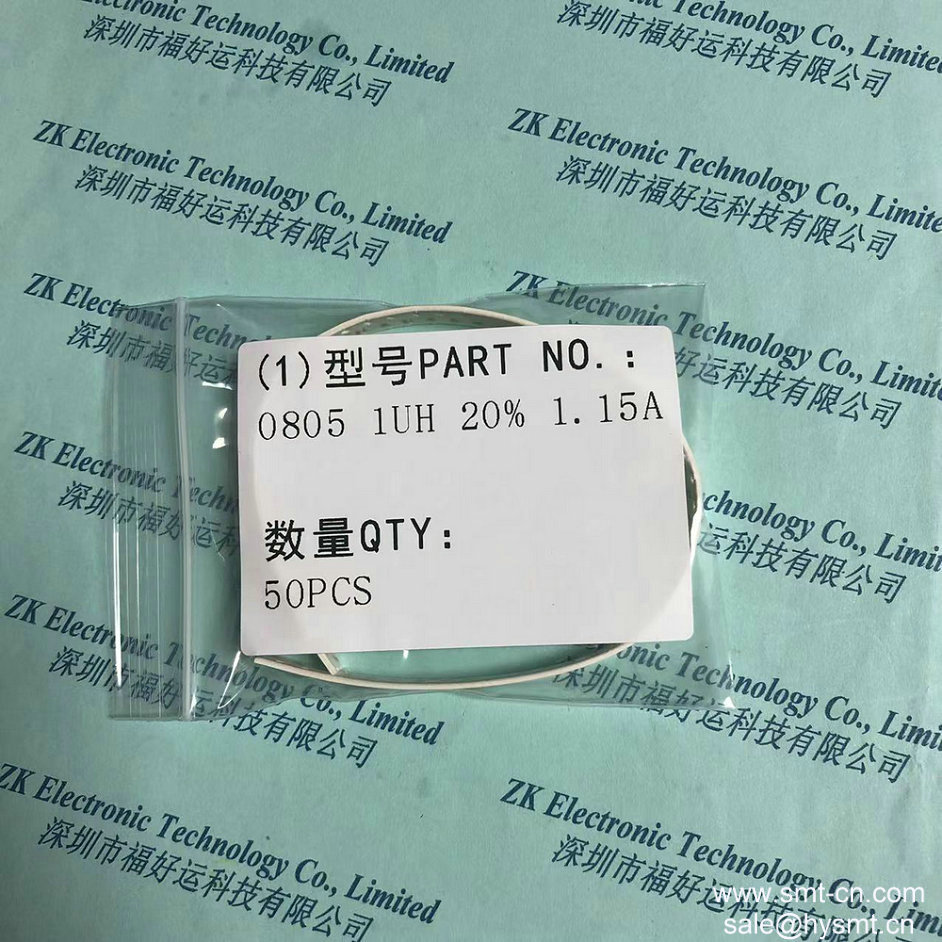

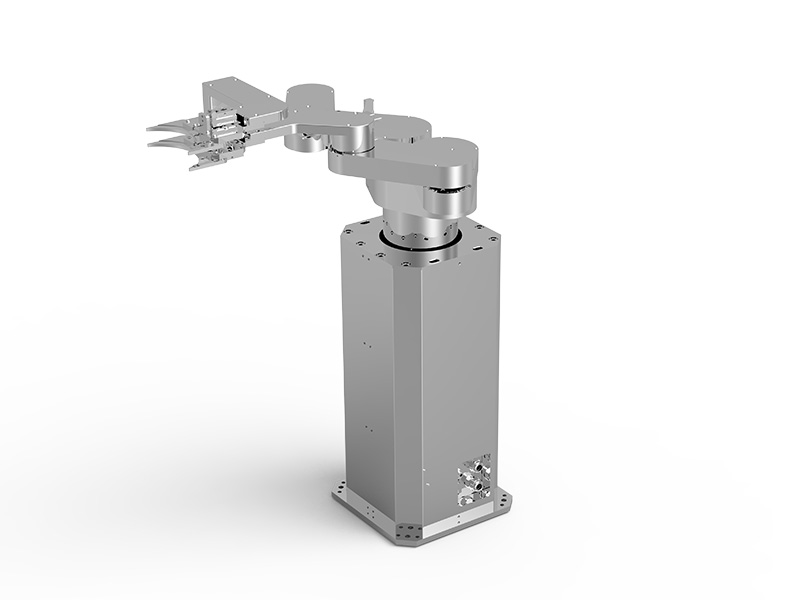

Other supplier products

|

|

Rep Office In China |

Setting up a Representative Office in ChinaWhen a foreign company contemplates about entering the Chinese market,Website:, it may first engage in a... |

|

|

China Branding |

China Branding Services: Co-create Powerful BrandsAs a full foreign investment service firm, we deeply understand the complexity of brands and bran... |

|

|

Chinese Green Card |

Regulations on Permanent Residence of Aliens in ChinaBrief IntroducationThe permanent residence of foreigners in China refers to that the period of... |

|

|

China Business Visa |

China Business Visa (F/M) The required documentation to support your application differs according to the visa you are seeking. Here we explain so... |

|

|

Startup Cities In China |

Where Should You Base Your Startup in China? China can be a great place to do business. But setting up shop in the world’s largest consumer tech ma... |

All supplier products

Same products